Tax Return Filing: Everything You’ll Ever Need to Know

Taxes come but once a year, and when they do, good luck ignoring them. From constant ads to news reminders, we bet you’ve had at least one sleepless night or distracted workday thinking about tax return filing. To sum up, your individual tax return isn’t going to file itself.

However, we know that for most people, filing your taxes is among the most dreaded tasks you have to take care of on any given year. Either the physical act of filing daunts you, or you just aren’t familiar with how to make the most of tax season and put money back in your pocket. In either case, you may instead decide to put off filing your taxes for so long that you end up making mistakes or filing late. Subsequently, you get hit with an audit or tax bill.

Your personal tax return doesn’t have to be as complicated as it might seem. With the right information, you can file your taxes—or hire a tax preparer—with confidence.

Why tax return filing?

As a full-service tax representation firm, we’ve seen and filed it all. Over nearly two decades, we’ve worked with clients from all walks of life to minimize their tax bills, maximize their refunds, and take the stress out of tax season. Though we’re always eager to help, we don’t think a lack of confidence should be what stops you from filing your own taxes. If that’s you, then the best way we can help is by giving you back that confidence.

So that’s what we’re here to do. In this article, we’ll be walking you through everything you need to know about individual tax return filing. From the forms you‘ll use to common tax return filing mistakes and FAQs, consider this the first and last guide to tax return filing you’ll ever need.

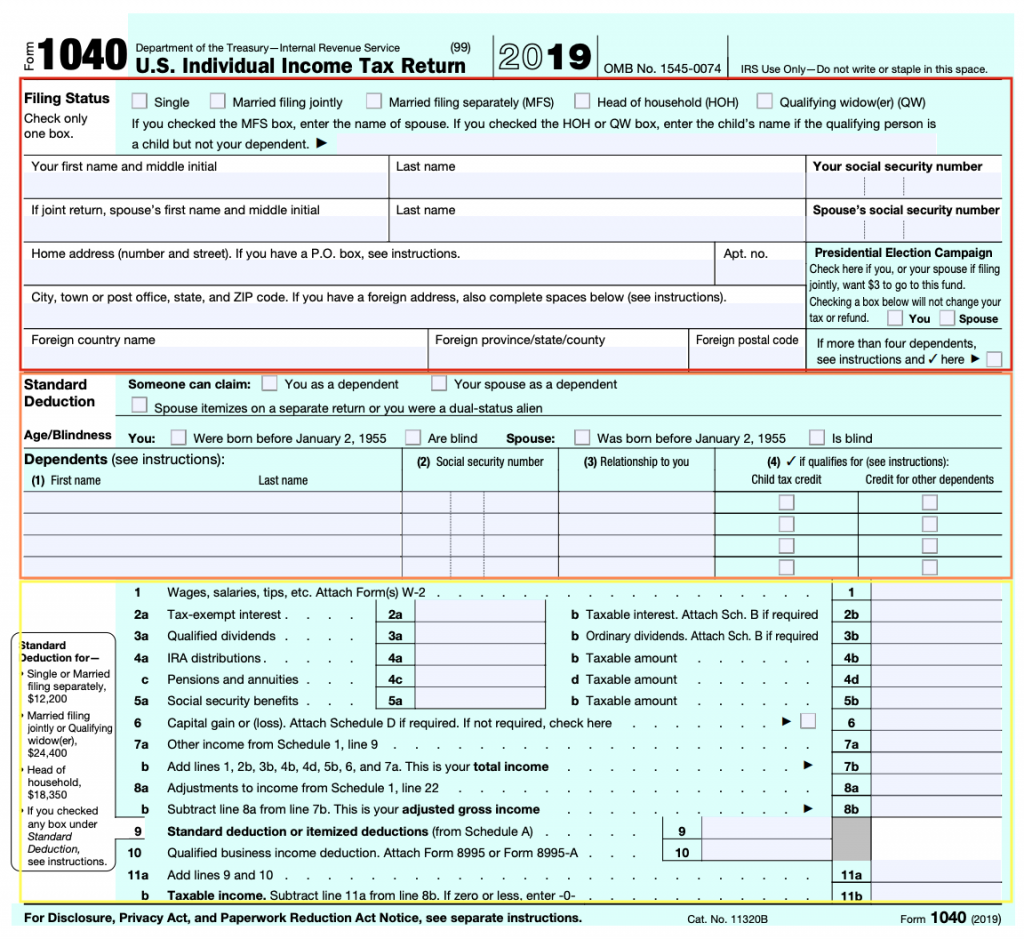

Tax Return Filing with Form 1040, U.S. Individual Income Tax Return

When you’re filing your taxes, you’re going to need Form 1040. Your tax situation may require additional forms or different versions of this form (like the new Form 1040-SR, designed for senior citizens), but you will always use the 1040 to file your individual tax return.

Generally speaking, on your 1040, you will accomplish a few basic things:

- Firstly, provide basic identifying personal information.

- Summarize your income for the year.

- Give a snapshot of the legal and financial situation that puts context around that income.

- Finally, sign the form.

Let’s break down the form, page by page. And color coded, because that’s how we roll.

Form 1040: Page 1

Red Box

In the red box, the first several lines focus on the basics. At the top of your sheet, you will indicate your tax filing status (which we’ll discuss further below), name, address, and your social security number. If you have a foreign address, you’ll include that here. This will, no doubt, be the easiest section of your tax return filing. But it goes without saying not to slip into autopilot. Without care, mistakes here can still end up triggering an audit.

Orange Box

In the orange box, you’ll indicate whether you or your spouse can be claimed as a dependent. If you can be claimed as a dependent, which typically only occurs up to a certain age for most filers, you will list that here. Below, you’ll list out your dependents, their social security numbers, and their relationships to you. We’ll touch on this more in a later section.

Yellow Box (Part 1)

In the yellow box, you will compile your basic income and expenses. Like we mentioned, your specific tax situation may require additional tax forms to calculate, but the 1040 represents the basics. You’ll combine any income from W-2s, any interest or dividends from investment accounts, social security benefits, and capital gains or losses. Then the form instructs you as to which totals to add and subtract, and allows you to choose whether to apply the standard or itemized deductions. We’ll dive into those in a later section, as well.

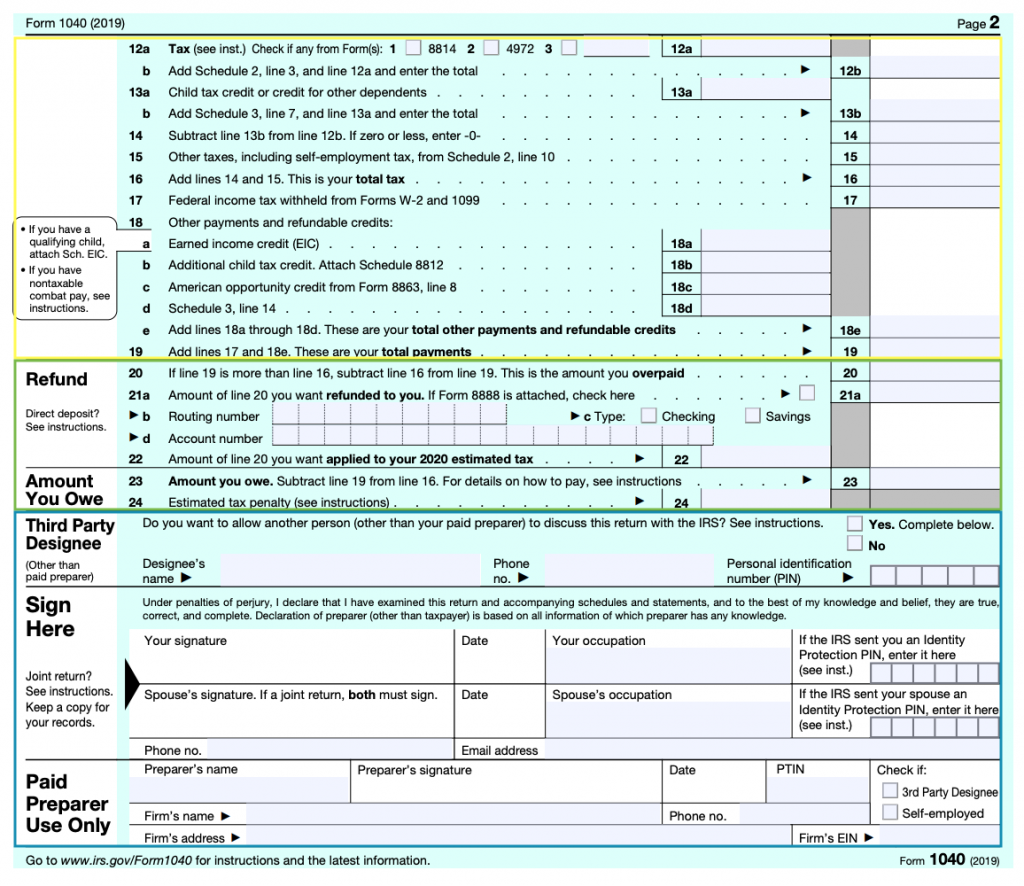

Form 1040: Page 2

Yellow Box (Part 2)

You’ll notice we continued the yellow box on this page. And we did that for an important reason. On page two, you continue, essentially, painting the picture that is your tax situation for the year. While on the first page, you filled out your basic income information, as this section continues on page 2, you’ll add things like tax credits, withheld income tax, and totals from additional tax forms.

Green Box

In the green box, the 1040 will instruct you how to determine whether you will owe the IRS money or if the IRS will owe you money. You know, that refund everybody’s after. The calculation goes as follows: Subtract line 19 from line 16. Line 19 lays out your total tax payments that you’ve made through your employer’s withholding, other payments, and refundable credits. However, line 16 lays out the total tax you owe. So if you’ve paid more than you actually owed in a year, then the IRS will owe you money back. And if you owe more taxes than you ended up paying, you’ll owe the IRS.

Blue Box

In the final, blue section, you’ll put a bow on your return by signing and dating it. However, you may not be the person physically preparing your tax return. You may have hired a tax preparer or enlisted the help of a third party to handle your taxes on your behalf. Depending on whom has filled your return, they will need to fill out the appropriate section. For third party designees, who may fill out your return if you’re ill or overseas, they may take on the role of discussing your return with the IRS. Paid preparers like Edge Financial include their name, PTIN, and additional information. So, if you’ve given someone else the okay to file on your behalf, they’ll sign off here.

(A Short) Glossary of Tax Return Filing Terms

Now that you have a good sense of the landscape of IRS Form 1040, we should take a moment to break down some of the common tax return filing terms that occasionally puzzle tax filers. Read them all, or skip to any that you might want a refresher on! After this, we’ll cover a few tips to avoiding errors on your tax return.

Filing Status

If your 1040 is a ship, then your filing status is your heading. (Not sure why we picked a sailing metaphor, but we won’t look back now.) Alongside your dependents, your filing status has the single greatest impact on your tax obligation. The options on your 1040 go as follows:

- Single – Unmarried, divorced, or legally separated.

- Married filing jointly – One tax filing option for married couples, which can sometimes save taxpayers money.

- Married filing separately – Another tax filing option for married couples, which in different cases can save taxpayers money.

- Head of household – Unmarried while paying over half the cost of maintaining a home for yourself and another relative who lives with you for over half the year. You should be able to claim them as a dependent.

- Qualifying widow(er) – If you’ve lost a spouse but maintain your home with a dependent child, you may qualify as a surviving spouse if you haven’t remarried. You can file using this tax status for up to two tax years.

Most importantly, your filing status will directly impact the benefit cutoffs you can claim through most tax deductions and tax credit limits. Additionally, it dictates your standard deductions and tax rates. In all cases, remember the date Dec. 31. Your filing status locks in on that date, so the IRS will consider you single if you get married on Jan. 2, or they’ll consider you married even if you’ve separated by then but not divorced.

Dependents

While we often think of dependents as children, your dependents may also include elderly parents or adult-aged children with certain disabilities. If you provide more than half the support of an individual in your home or in your care, they may count as a dependent.

Standard Deduction

When filing your tax return, you can decide between the standard deduction and itemized deductions. The standard deduction offers a relatively high cap, but eliminates all other itemized deductions. So, you choose your path and stick with it.

For reference, tax deductions lower your taxable income, which makes them a little bit different from tax credits, which we’ll discuss next. The standard deduction amount adjusts each year and varies based on your filing status, so the total benefit will differ. During the 2019 tax year that you’ll file in 2020, expect these totals:

- Single or Married filing separately: $12,200

- Married filing jointly or Qualifying window(er): $24,400

- Head of household: $18,350

Certain exceptions to whom can claim the standard deduction apply. So, check out the IRS’s site for additional details.

Itemized Deduction

While the standard deduction is, well, standard, you may choose to itemize deductions for a number of reasons. These reasons can include the following:

- State and local income or sales tax

- Real estate and personal property taxes

- Mortgage interest

- Mortgage insurance premiums

- Personal Casualty and theft losses from a federally declared disaster

- Donations to a qualified charity

- Unreimbursed medical and dental expenses that exceed 7.5% of adjusted gross income

You may see how the itemized deductions add up. While a simple tax return with one income stream may work best with the standard deduction, any number of interest rates, taxes, and health expenses can add up and push you over the total of the standard deduction.

Refundable Tax Credit

When using a tax credit during the tax return filing process, you have two options: refundable tax credits and nonrefundable tax credits. Both bring down the total tax you owe, rather than just lowering your taxable income like tax deductions. But refundable tax credits can result in a refund. The Earned Income Tax Credit can lower your total tax liability, in some cases, to less than zero—meaning the IRS will owe you a refund.

For example, if you claim a $1000 tax credit and only owed $500 in taxes, you’ll end up with a $500 refund.

Nonrefundable Tax Credit

With nonrefundable tax credits, you can lower your tax bill down to zero dollars but not beyond that point. However, nonrefundable tax credits can’t provide you with a refund.

For example, if you claim a $1000 tax credit and only owed $500 in taxes, you’ll end up owing $0 in taxes. You won’t have to pay but you won’t get a refund.

5 Tips for Error-Free Tax Return Filing

If you want to avoid errors on your tax return, there are a few fairly simple tips to accomplishing that. Now, let’s walk through them one by one.

1. Don’t Wait Until the Last Minute

Year-in and year-out, one of the most common tax return filing mistakes remains starting late. When you start filing your tax return late, a few things happen. Firstly, you feel rushed. When you feel rushed, you’re more likely to make mistakes and you’re more likely to rush to finish portions of your tax return that you really should take your time with.

Here’s an example: Have you ever stayed up late filing your taxes? Well, when you’ve stayed up until 1am or 2am, you’re already not in the best headspace. Certainly, you could feel tired and frustrated, and your desire to climb into your bed may take away some of your focus from the task at hand. But that lack of focus can lead to mistakes on your taxes and result in a tax audit.

2. Look for Tax Credits

Meet your best friend: Tax credits. Unfortunately, a lot of taxpayers don’t take the time to seek out and identify tax credits that may apply to them. Yes, if you complete your taxes on certain tax prep software, they may alert you to tax credits that could apply to your tax situation. But most tax filers end up completely ignoring applicable tax credits.

For example, have you heard of the American Opportunity Tax Credit and the Lifetime Learning Credit? Both of these tax credits can greatly assist taxpayers to help them cover expenses related to their educational pursuits. But don’t be mistaken; they’re different credits. If you don’t check both of them out, you can easily miss out on your chance to truly maximize your tax refund.

3. Organize Your Tax Paperwork

We’ve discussed how last-minute tax return filing can lead to errors and issues with your taxes, but the same principle ultimately applies to your tax paperwork in general. Your tax documents, like tax forms, receipts, and everything else you’ll need won’t organize themselves! In fact, for most people, one of the most arduous parts of the tax return filing process every year remains hunting down all the tax forms, receipts, and emails that you’ll need when you file!

For example, do you remember all the charitable donations you made last year off-hand? We bet not. However, those charitable donations may just be tax deductible. Without a thorough approach to your tax paperwork organization, you might completely forget that $50 donation you made as a gift. In the same vein, perhaps you forget your post-Spring cleaning trip to Goodwill. The further in advance you start preparing those tax documents, the more thorough your tax return. And likely, the more you’ll save.

4. File Your Tax Return Early

Okay, it’s time for a big tax preparation insider secret. You need to file your taxes early! On top of avoiding that last minute filing rush that leads to errors and missed savings, let us explain a few more upsides to getting your return out the door early. The IRS can get overwhelmed around Tax Day, which leads to delays that can keep you from getting your tax refund in a timely matter. However, when you file early, you beat that rush, which means getting your hands on your refund early.

Another benefit to starting your tax return filing early is that if you do plan to hire a tax preparation service, you’ll have more time to find the right tax preparer. Then, you can let them take your tax return filing off your hands entirely. Which brings us to our final tip.

5. Get Professional Help

Very few people can count themselves as tax professionals. And in our experience, it shows. One of our favorite parts of working with our clients is the experience of getting them a larger refund, maximizing their savings, or leading them to a tax debt solution that they didn’t previously know about. Most people don’t have the tax background or legal background to leverage the IRS tax code to their benefit. In short, it shows on their returns.

Should we all be expected to know the tax code inside and out? Absolutely not! But by hiring a tax representation team that has built their livelihoods around helping people through tough tax situations, you gain the best of their knowledge. When looking to maximize your taxes without adding days of research to your schedule, you can’t beat a tax preparation service.

Bonus Tax Return Filing Tips (from the IRS)

You really thought we were done, didn’t you? Nope. For more tips on how to avoid common tax return filing errors, check out this video—straight from the IRS. It outlines some of the most common tax return issues they see.

Tax Return Filing FAQs

We get questions about the tax filing process all the time, and hey! It comes with the territory, and we’re more than happy to help. We’ve collected a few of the most common questions about filing your taxes so you don’t even have to worry about asking them.

What if I make a mistake on my return?

At one point or another, most taxpayers will likely make some sort of error on their taxes! Certainly, these errors may be small, like an extra zero or a misplaced letter. However, some mistakes can tangibly affect your tax return and lead to an audit.

Of course, the best way to avoid an audit is always to double and triple check your tax return before filing your taxes. However, if you discover your error after completing your taxes, don’t stress. Identify the issue, scan your full tax return to check for more, and file an amendment to your tax return. An amended tax return functions the same way a normal tax return does, but it serves to correct any mistakes you may have made.

Let’s say you unintentionally left out an income stream. For example, you just completely forgot you started renting out a vacation home. If this happens, file an amended return and make sure to add any additional payment you might owe. Therefore, the amended return will complete your tax return or correct any errors that snuck their way in.

What if I get audited?

If you receive notice of an audit, don’t panic. Audits are relatively uncommon, but most audits aren’t all that serious. In many cases, an issue with someone else’s taxes or a misplaced number may trip the IRS’s computer that does the checking!

However, you should take your audit seriously. In the case the IRS reaches out, we recommend you get in touch with a tax professional right away. Not only can a tax representation firm help you understand the audit, but they can also help put you in a position to adequately defend yourself.

Welcome to Expert Tax Return Filing!

While the tax return filing process may never leave you quite as excited as the latest season of your favorite TV show, we hope you’ve come around a little bit. With a better understanding of how to file your tax return, forms and credits, and answers to your most common questions, perhaps you dread tax season just a bit less now.

Now, it’s time to put your new tax return filing skills into practice. We are confident you can get the job done right, and we think your tax return will thank you for it. So, happy filing!

Have questions about your tax return? We are always here to help. Give us a call at 1-800-410-8605 or send us a message today and let’s get your tax return filing process started on the right foot.

Get top tax secrets, delivered.

Comments

Contact Us

1-800-410-8605 info@edgefinancial.com

6300 Canoga Ave #101

Woodland Hills, CA 91367