Category: Tax Preparation

Let’s talk tax credits. Ignoring every other complicated equation and factor, your tax bill really comes down to two things: how much you’ve earned and how many expenses you’ve accrued. On the earning side, your income serves as the main fa...

“Should I itemize my deductions?” “Do you take the standard deduction, or itemize?” Not to make too many assumptions here, but there’s a good chance that in the past couple of years, you’ve take the standard deduction. And...

Just like Sweethearts, our tax tips are back! Did you miss them? Or did you even realize those candy hearts had gone in the first place? Sadly, it’s true. The company that makes the pastel hearts with romantic and flirty sayings shuttered back in 2...

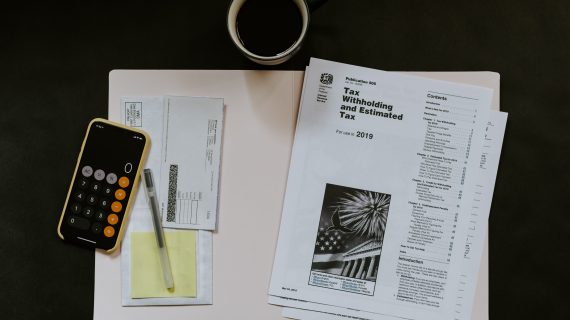

Tax season is here! And you’re going to have to file your tax return for the 2019 tax year at some point or another. In our opinion, you should get started on your taxes as soon as humanly possible. We’re punctual like that. However, we’re not ...

Is it nearly tax season already? It feels like Tax Day was only yesterday. Well, we’ve feverishly checked our calendars—oh, about seven times now—and it’s about that time of year again. So that means you need to start thinking about filing yo...

There’s nothing like a good tax credit. Truly, nothing at all seems to feel quite as good during tax season as discovering you qualify for a tax credit or tax deduction you didn’t expect. So it’s time to discuss the Earned Income Tax Credit...

You’ve decided to take the plunge and hire a tax preparer. So you need to know what to ask tax preparers before hiring one. We may be a little bit biased (Okay, a lot biased.), but we think that hiring a tax preparer is one of the smartest things y...

How should we start writing our last post of the decade about financial resolutions for 2020? Just like that, we guess! The 2010s have flown by, and we hope they’ve been good for you. We’re sure there have been ups and downs; we know our audit de...

Prev

Prev